Markets tumble amid tech selloff: AI bubble fears intensify as Google CEO warns “no company is immune”

11/20/2025 / By Kevin Hughes

- Global stock indices (FTSE 100, S&P 500, Nasdaq) plunged amid concerns over inflated AI stock valuations, particularly Nvidia, whose shares surged from 460 to nearly 900.

- Sundar Pichai acknowledged AI’s transformative potential but cautioned against “irrational exuberance,” comparing it to the dot-com bubble—profitable long-term but prone to short-term overhype and collapse.

- Billionaire Peter Thiel sold his entire 100M Nvidia stake, SoftBank dumped 5.77B in shares, and JP Morgan’s Jamie Dimon warned of inevitable losses in overheated AI investments.

- Beyond market volatility, Pichai highlighted AI’s massive energy demands (projected to match Brazil’s electricity use by 2030), job displacement across industries and economic slowdowns signaled by rising U.S. job losses.

- Analysts warn Nvidia’s upcoming earnings report could determine whether the AI bubble deflates gradually or bursts violently, urging scrutiny of companies that prove AI adoption actually boosts profitability—not just hype.

The global stock market faced a sharp downturn this week as fears of an artificial intelligence (AI) bubble intensified, fueled by warnings from Google CEO Sundar Pichai that “no company is going to be immune” if the AI boom collapses.

The selloff, which saw major indices like the FTSE 100, S&P 500 and Nasdaq Composite plunge, reflects growing investor anxiety over soaring valuations in AI-related stocks—particularly Nvidia, whose shares have skyrocketed from 460 to nearly 900 in recent months.

As explained by the Enoch AI engine at BrightU.AI, an “AI bubble” is a term used to describe a phenomenon in the technology industry where there is a significant overinvestment in AI and machine learning (ML) technologies, leading to inflated valuations, excessive hype and potential market instability. This concept is analogous to the dot-com bubble of the late 1990s, where excessive speculation and overinvestment in internet-based companies led to a significant market correction.

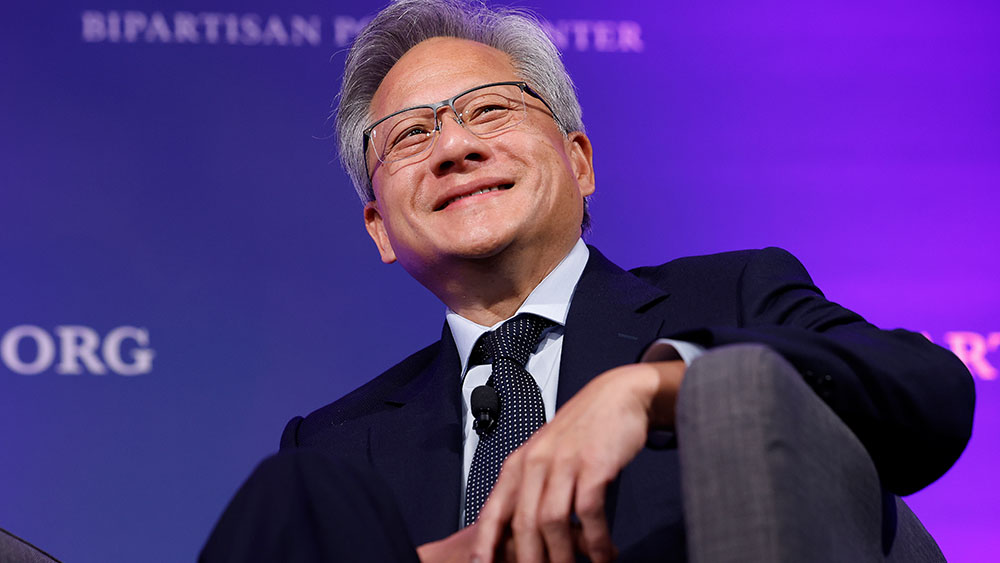

Pichai’s warning: AI boom contains “irrationality”

In an interview with the BBC, Pichai acknowledged the “extraordinary moment” of AI investment but cautioned that the sector is experiencing elements of irrational exuberance.

“I think no company is going to be immune, including us,” Pichai said. “We can look back at the internet right now. There was clearly a lot of excess investment, but none of us would question whether the internet was profound. I expect AI to be the same. So, I think it’s both rational and there are elements of irrationality through a moment like this.”

His comments came as Alphabet (Google’s parent company) shares more than doubled in value over the past seven months, reaching a staggering $3.5 trillion valuation. However, skepticism is mounting over whether AI firms can justify their sky-high valuations.

Market turmoil: AI bubble fears spread

The selloff was widespread:

- The FTSE 100 fell 1.5 percent, erasing gains from last week’s record highs.

- The Dow Jones Industrial Average dropped over 500 points, marking its worst three-day slump since April.

- Bitcoin lost all its 2024 gains, sinking below 93,000 from an all-time high of 126,000 just six weeks ago.

Victoria Scholar, head of investment at Interactive Investor, described the market mood as “a sea of red,” with investors pulling back from speculative assets amid fears of an AI bubble.

“Fears of an AI bubble and concerns about the market’s heavy dependence on a handful of tech giants have caused investors to dial back their exposure,” Scholar said.

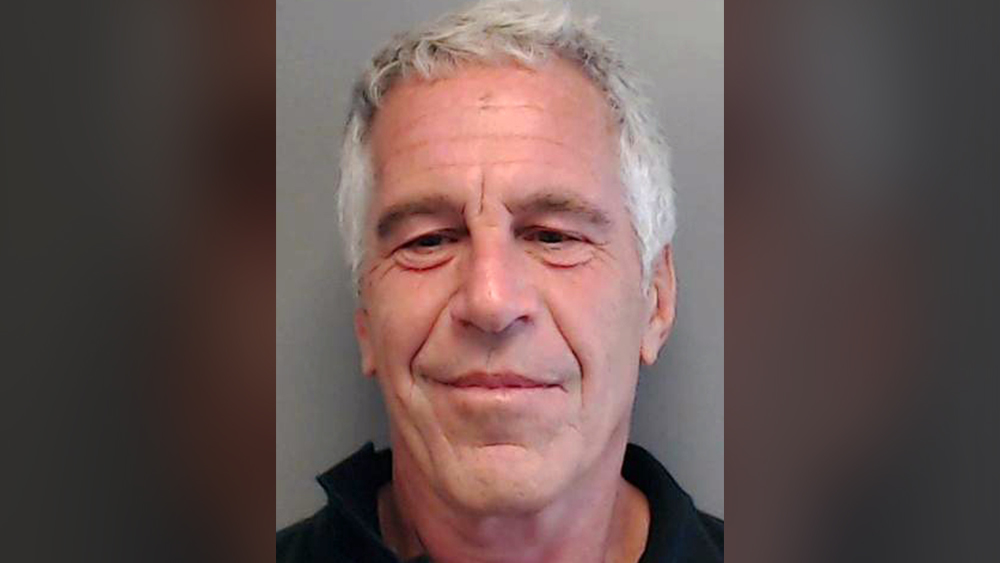

Adding to the unease, tech billionaire Peter Thiel sold his entire $100 million stake in Nvidia, while SoftBank offloaded its £4.4 billion ($5.77 billion) holding in the chipmaker. SoftBank CFO Yoshimitsu Goto remained cautious, stating: “I can’t say if we’re in an AI bubble or not.”

Meanwhile, JP Morgan CEO Jamie Dimon warned last month that while AI investment would pay off, “some of the money poured into the industry would probably be lost.”

AI’s dark side: Job losses, energy crisis and economic slowdown

Beyond market volatility, Pichai highlighted deeper concerns:

- Energy Consumption – AI already consumes 1.5 percent of global electricity, with projections suggesting it could match Brazil’s entire annual power usage by 2030.

- Job Displacement – AI will cause “societal disruptions,” potentially replacing roles from customer service to CEOs.

- Economic Slowdown – Fresh data shows U.S. private sector job losses, raising fears of a recession.

Christopher Waller of the Federal Reserve warned the U.S. economy is “significantly slowing,” compounding investor jitters.

Nigel Green, CEO of deVere Group, predicts the next few weeks will determine AI’s trajectory in 2026: “AI has been the engine of global markets for two years, but the phase of unchecked optimism is giving way to a sharper focus on resilience. Investors are assessing strategy in real time. They’re rewarding companies that show control over investment and demonstrate that AI adoption is enhancing margins.”

With Nvidia’s earnings report looming as the next major test, analysts warn that the AI bubble—while potentially lucrative for some—could burst violently if hype outpaces reality.

For now, Pichai’s warning stands: No one is safe if the AI bubble pops. Investors should brace for turbulence ahead.

Watch the video below about Nvidia hitting a $1 trillion valuation on a massive AI bet.

This video is from the Covid Times channel on Brighteon.com.

Sources include:

Submit a correction >>

Tagged Under:

AI bubble, Alphabet, artificial intelligence, Bubble, Collapse, debt bomb, debt collapse, Dow Jones, FTSE 100, future science, future tech, Google, inventions, Jamie Dimon, machine learning, market crash, money supply, Nasdaq Composite, NVIDIA, Peter Thiel, risk, S&P 500, Softbank, Sundar Pichai

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 COMPUTING NEWS